With an Amortized Mortgage or Trust Deed Loan:

Cash-out may be allowed if the proceeds are used for building improvements. The security for the loan is provided by either a mortgage or deed of trust.

Real Estate And Mortgage Dictionary Family Services Inc

Computerized trust deed servicing takes all the fuss out of fully amortized partially amortized and interest only loans.

. Interest may be paid in arrears that is at the end of each period for which it is earned b. Which statement about interest on a fully amortized mortgage or deed of trust loan is TRUE. Payment specific terms.

Trustee will be an agent of the beneficiary. Terms of amortization period or interest only. The final interest payment will be.

Regular periodic payments are made over a term of years. When a loan is fully amortized by equal monthly payments of principal and interest the amount applied to principal Increases while the interest payment decreases A subordination clause in a. Trustees exercise the power of sale in a foreclosure.

The document that provides evidence that a certain property is pledged as collateral for a loan is the. They do not secure a First and Second Lien the second Note and Deed only secure any advances that HUD may have to make to you after the lender stops and HUD begins. Technically even if your house is mortgaged it is still owned by you however the mortgage is a loan that you pay back until the entirety of the loan is repaid.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. Another benefit is the interest paid on a 2nd mortgage may be tax deductible up to 100000 loan amount. There will be 2 Notes and 2 Deeds of Trust or Mortgages.

In the case of a mortgage the mortgage servicer executes a power of attorney giving the attorney-in-fact the power to sell the property. Deed of trusts differ from mortgages in that there are three parties involved. Please be sure to inquire as to the status.

Most mortgage and deed of trust loans are amortized loans. Only interest is paid each period d. Certainly the mortgage will need to be paid off during the trust administration but at least the cost and burdens of probate will be eliminated.

If you decide to refinance this first mortgage CDC will subordinate your SBA loan to a straight refinance of your first trust deed loan. The lender gives the borrower money to buy a property. Loans to buy real estate are generally secured by.

A way to lower the initial interest rate on a mortgage or deed of trust loan. A Mortgage Deed also known as a Mortgage Agreement is a document where a borrower of money grants the lender of that money conditional ownership in a property as a security interest against the loan until the loan is paid in fullIf the borrower fails to repay the money as agreed the lender then becomes the owner of the property used as security and will. That is they are paid off slowly over time in equal payments of principal and interest P I payments.

Dear Trust Deed Investor The following is a list of potential trust deeds that are currently available. They may also be purchased through your IRAKEOUGH accounts or pension. Can you sell a house with a deed of trust.

The borrower tenders the money to the seller. If deed of trust is executed instead of a mortgage lender will be beneficiary of the trust. The lender beneficiary the borrower trustor and the trustee.

Deeds of trust transactions are structured in the following five steps. Whether you have a deed of trust or a mortgage they both serve to assure that a loan is repaid either to a lender or an individual person. Available Trust Deeds.

What if you dont own your home. The loan amount on the documents will either be blank total 150 of your property value or 150 of the HUD Lending Limit. A borrower obtains a 30-year fully amortizing mortgage loan of 30000 at 8.

If theres a deed of trust on a property the lender can sell the property and pay off the loan. As always these trust deeds may be purchased in full or we may fractionalize them. A 2nd trust deed loan can provide simple interest loan payments which are amortized on an annual basis rather than amortized daily.

With a fully amortized loan the interest rate and the amount of payment. Straight line amortized mortgage 15 Simple interest Principal x interest rate x time 16 Charging interest in excess of rate set by state laws Usury 17. Will service your trust deed investment for.

The interest portion of each payment increases throughout the term of the loan c. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid. Maturity date of loan and provision for extension if any.

In both cases the. Trust deed or mortgage. A deed of trust is needed when a traditional lending service ie a bank is not being used or when certain states require deeds of trust instead of mortgages.

The low construction costs and low interest rates that are currently available to banks mean a lot of growing churches have a need for loans. A deed of trust. Whether your loan falls under the mortgage or deed of trust definition youll need to get approval from the lender before you sell your home for less than you owe.

A deed of trust is a type of secured real estate transaction that some states use instead of mortgages. Generally your first trust deed loan from a bank or other lender has a higher interest rate than the SBA 504 loan. Accompanied by a mortgage or deed of trust on the property.

Recourse to the borrower if any. Trust Deed Company has collected hundreds of millions of dollars for private investors since 1977. Payment offsets interest rate and monthly payments during first few years.

The amortization rate expressed in years refers to how many years of monthly payments of principal and interest it will take for the borrower to pay the entire loan down to a zero balance. In most cases youre aware that mortgage-paying customers can rely on residential loans but the church mortgage falls within the definition of an enterprise that qualifies for commercial financing. For example a loan with 30 years of amortization means that if the buyer makes the minimum scheduled principal and interest rates the balance will be zero and the.

Lump sum paid in cash at closing. This instrument deed of trust creates a.

Mortgage Brokering In Ontario Cheat Sheet By Utkarsh121 Download Free From Cheatography Cheatography Com Cheat Sheets For Every Occasion

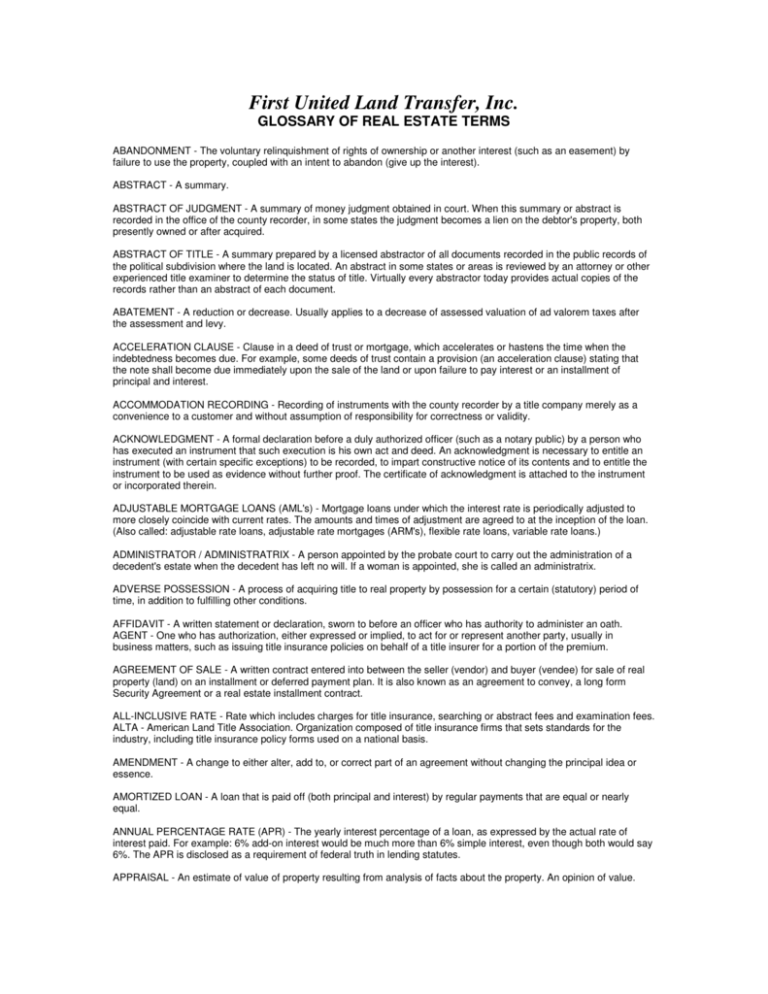

Real Estate Terms First United Land Transfer

Sample Printable Mortgage Broker Submission 2 Form Mortgage Brokers Real Estate Forms Mortgage Loan Originator

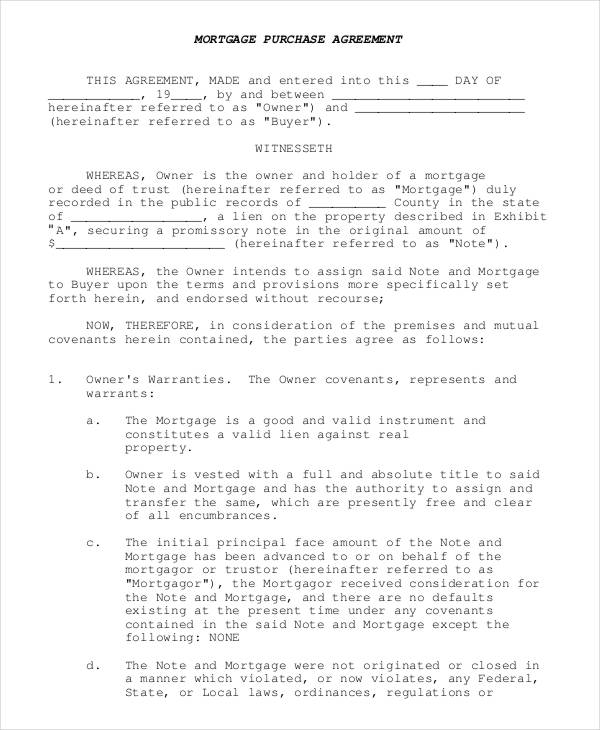

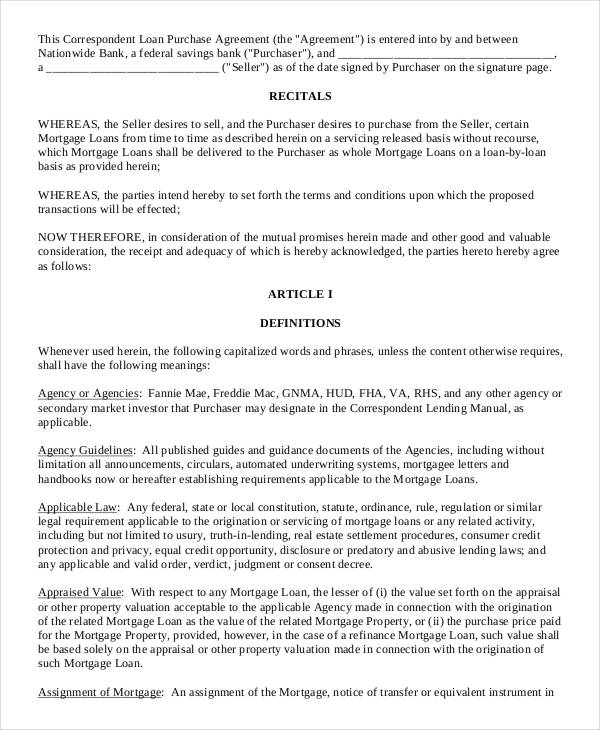

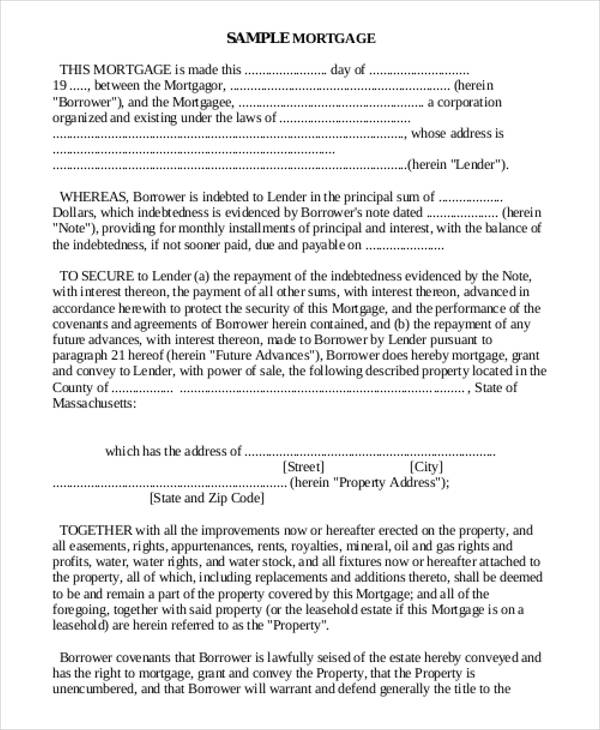

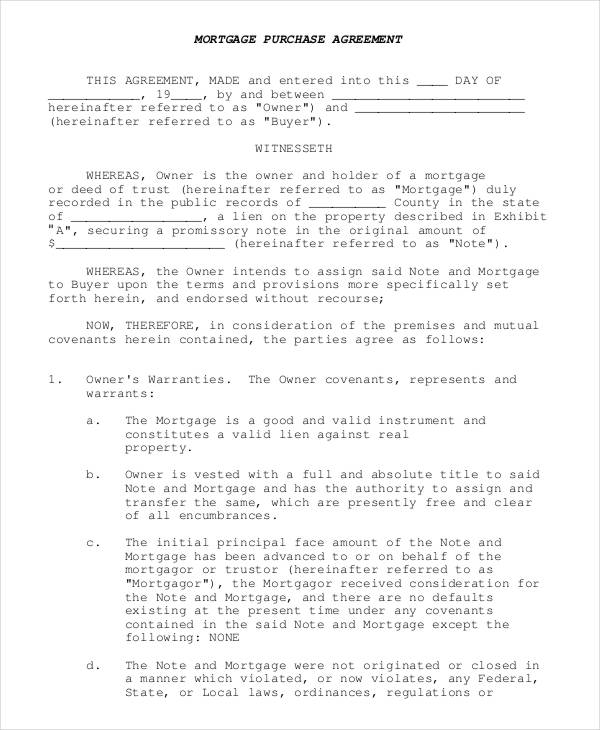

6 Mortgage Contract Templates Free Sample Example Format Download Free Premium Templates

6 Mortgage Contract Templates Free Sample Example Format Download Free Premium Templates

Commercial Mortgage Loans And Fund Sources Ppt Download

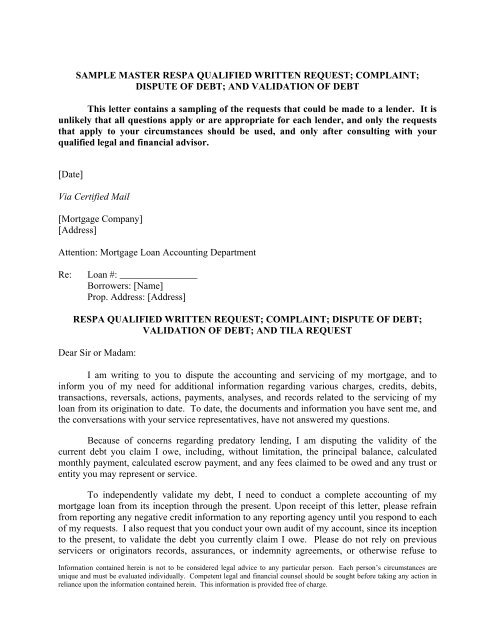

Sample Master Respa Qualified Written Request

How Does Prepaying Your Mortgage Actually Work Sensible Financial Planning

Free Seller Financing Addendum To Purchase Agreement Pdf Word Eforms

Sample Printable Offer To Purchase Real Estate Pro Buyer Form Real Estate Forms Wholesale Real Estate Real Estate Templates

6 Mortgage Contract Templates Free Sample Example Format Download Free Premium Templates

Fully Amortized Loan A Definition Rocket Mortgage

6 Mortgage Contract Templates Free Sample Example Format Download Free Premium Templates

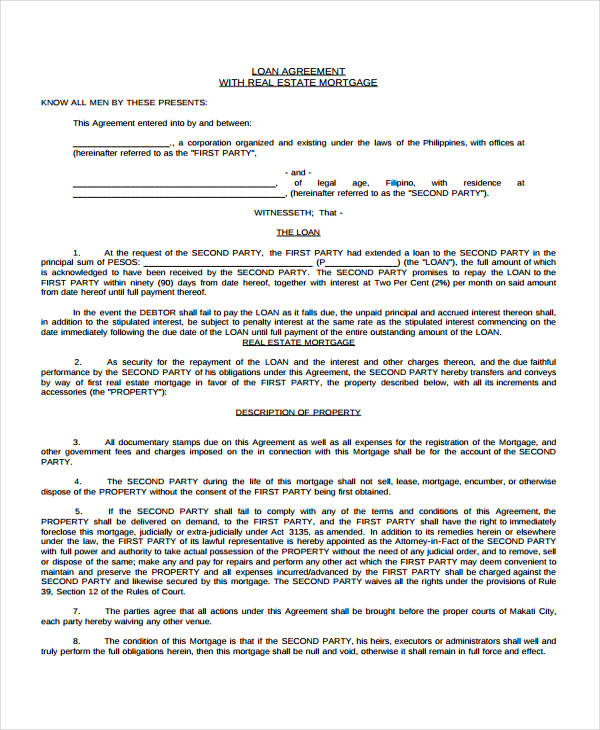

Free 56 Loan Agreement Forms In Pdf Ms Word

Key Terms Mortgage A Document That Makes Property Security For The Repayment Of Debt Mortgagee The Party Receiving The Mortgage The Lender Mortgagor Ppt Download

/148168412-5c649cdb46e0fb000184a4ff.jpg)

Comments

Post a Comment